COMMUNITY INVESTMENT TAX CREDIT

CITC Program 2022

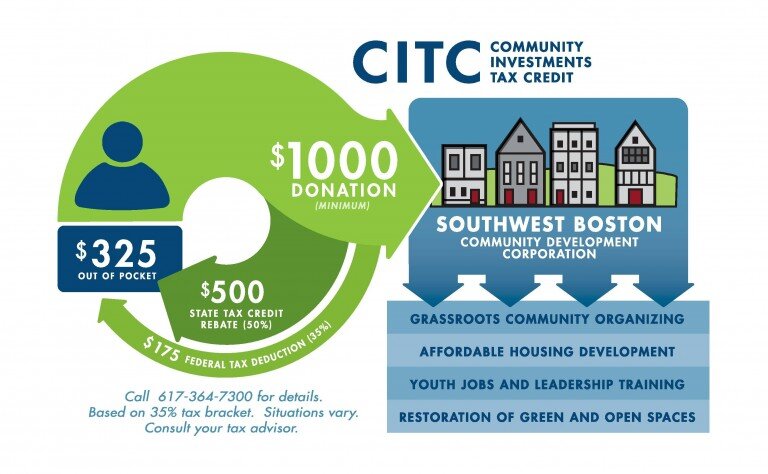

Your donations through the Community Investment Tax Credit Program have a tremendous impact on community development projects, but a smaller impact on your wallet. CITC Donations are eligible for 50% state tax credit. The CITC program is open to individuals, businesses, foundations and other non-profits both in and out of MA. Donors must give a minimum of $1,000 and they will then receive $500 back from the state.

Click here to make a CITC donation! Please call us at 617-364-7300 if you have any questions!

Southwest Boston CDC is a 501(c)(3) organization. Our federal tax ID is 04-3562853. Your contribution is tax exempt to the fullest extent of the law. Special thanks to Graphic Designer Matt Smith for his pro-bono work to design the info graphic above.